![]() Homeowners insurance is an important part of protecting your home and possessions. There are several factors that can affect the cost of your homeowners’ insurance, including:

Homeowners insurance is an important part of protecting your home and possessions. There are several factors that can affect the cost of your homeowners’ insurance, including:

![]() Location – Premiums will be higher in areas where there is a higher risk of natural disasters, such as hurricanes or flooding.

Location – Premiums will be higher in areas where there is a higher risk of natural disasters, such as hurricanes or flooding.

![]() Age of Home – Older homes may require more coverage due to their age and the potential for damage.

Age of Home – Older homes may require more coverage due to their age and the potential for damage.

![]() Building Materials – Homes built with sturdier materials like brick or concrete will generally have lower premiums than those with less durable materials like wood.

Building Materials – Homes built with sturdier materials like brick or concrete will generally have lower premiums than those with less durable materials like wood.

Come out and support our local theatre! This is the first of several productions for 2023.

Come out and support our local theatre! This is the first of several productions for 2023.

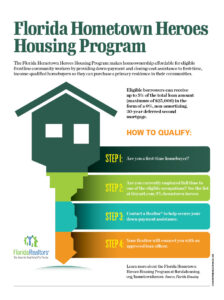

Great program! Contact me for a list of Lenders that can help you with this program.

Great program! Contact me for a list of Lenders that can help you with this program.