Dreaming of Moving in 2023?

First Federal Bank Residential Lending-Equal Housing Lender NMLS # 408902

Does your backyard lack the designated entertaining space you want? Is your kitchen starting to feel a little cramped? Do you have a need for additional rooms? Whatever the reason, it may be time to make a move to a home that has what you need. Contact me to learn more about what’s available in our local market.

![]() 300 NORTH WAUKESHA STREET, Bonifay, FL, United States, Florida

300 NORTH WAUKESHA STREET, Bonifay, FL, United States, Florida

![]() (850) 573-6304

(850) 573-6304

The right agent

Homeowners Insurance

![]() Homeowners insurance is an important part of protecting your home and possessions. There are several factors that can affect the cost of your homeowners’ insurance, including:

Homeowners insurance is an important part of protecting your home and possessions. There are several factors that can affect the cost of your homeowners’ insurance, including:

![]() Location – Premiums will be higher in areas where there is a higher risk of natural disasters, such as hurricanes or flooding.

Location – Premiums will be higher in areas where there is a higher risk of natural disasters, such as hurricanes or flooding.

![]() Age of Home – Older homes may require more coverage due to their age and the potential for damage.

Age of Home – Older homes may require more coverage due to their age and the potential for damage.

![]() Building Materials – Homes built with sturdier materials like brick or concrete will generally have lower premiums than those with less durable materials like wood.

Building Materials – Homes built with sturdier materials like brick or concrete will generally have lower premiums than those with less durable materials like wood.

Washington County Amnesty Day

What is a HELOC?

Money mistakes to avoid

Spanish Trailhouse

Come out and support our local theatre! This is the first of several productions for 2023.

Come out and support our local theatre! This is the first of several productions for 2023.

To build or buy

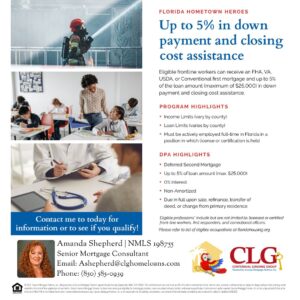

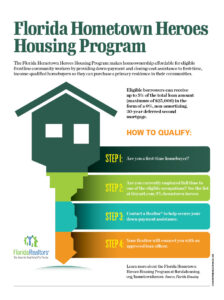

Florida Hometown Heroes Housing Program

Great program! Contact me for a list of Lenders that can help you with this program.

Great program! Contact me for a list of Lenders that can help you with this program.